Here’s a bleak but likely reality. It appears we’ll all be headed over the coming fiscal cliff regardless of the outcome of the upcoming elections. That means, according to the CBO, a 4% hit on the GDP, lower taxable incomes and higher unemployment. As a result, many including the CBO are predicting a recession in 2013. So, what should a business do to prepare? Although strategies and tactics will vary somewhat according to industry, there is one thing every small business should do now: plan. And, no. Plan is not a dirty four-letter word. It’s your opportunity to spot greener pastures when times are tough.

Here’s a bleak but likely reality. It appears we’ll all be headed over the coming fiscal cliff regardless of the outcome of the upcoming elections. That means, according to the CBO, a 4% hit on the GDP, lower taxable incomes and higher unemployment. As a result, many including the CBO are predicting a recession in 2013. So, what should a business do to prepare? Although strategies and tactics will vary somewhat according to industry, there is one thing every small business should do now: plan. And, no. Plan is not a dirty four-letter word. It’s your opportunity to spot greener pastures when times are tough.

Unfortunately, many small businesses fail to plan because they don’t see immediate value from it. To this I have one thing to say: get over it. “A failure to plan is a plan for failure”. You shouldn’t be looking to just improve your chances for survival in the coming year. You should be looking to thrive! It’s time for small business leaders to buck the trends. “Only dead fish swim with the current”. To thrive, you should do three things and then put them into a strategic plan that guides you through the coming recession.

Business Model Scenario Planning

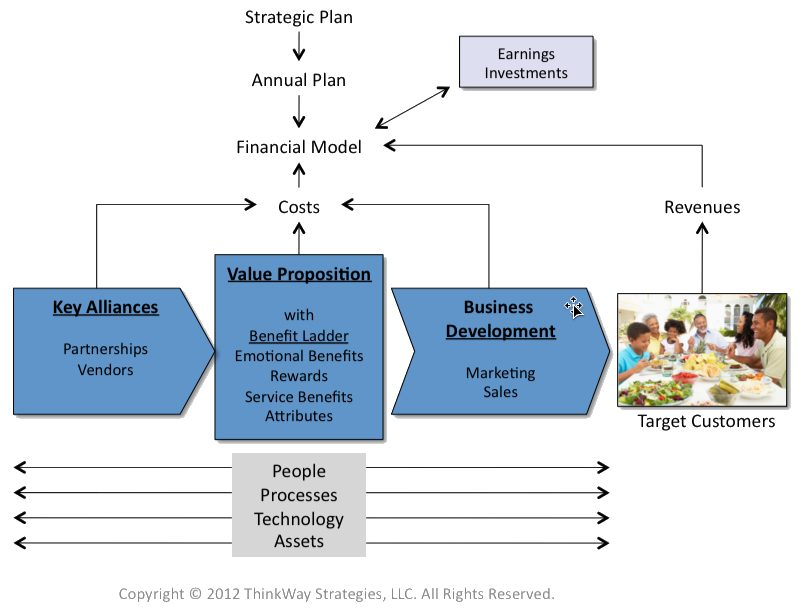

Go through a business model planning exercise that articulates how the business model will change leading up to and during the recession. There are several questions you should be asking and answering. How does the business model work now vs. during a recession? What parts of the business model will change? The financial model? Cash conversion cycle changes (especially, working capital)? Will your core value proposition change? How about the revenue model, business development or markets served? Will you need new partnerships and alliances in the coming recession? How can your suppliers help you?

will change leading up to and during the recession. There are several questions you should be asking and answering. How does the business model work now vs. during a recession? What parts of the business model will change? The financial model? Cash conversion cycle changes (especially, working capital)? Will your core value proposition change? How about the revenue model, business development or markets served? Will you need new partnerships and alliances in the coming recession? How can your suppliers help you?

Business Development Planning

You need to go through all aspects of the business development model and put together a plan that will actually grow your business during the recession rather than accept retraction. Marketing should be more aggressive, not less. Your plan should answer basic questions. How will our customer/consumer change? Which customers should we actually prune from the portfolio? What will we do with pricing? The 3 remaining P’s? Will our positioning change as a result of changes to our target market? Frame of reference? Point of difference? Reasons to believe?

Portfolio Pipeline Planning

Honestly, I don’t know of a single small business that I’ve seen do this. But if they did, they would have a full pipeline of qualified new product opportunities to choose from. And they’d have a full pipeline of qualified productivity (cost savings and cash flow enhancing) opportunities to choose from. Which ones are actually pursued depends on the situation and resource availability. Portfolio pipeline planning keeps businesses from knee-jerk responses and automatic employee layoffs. Instead, it provides an array of choices to help the business when times get tight.

These three planning activities are key elements of a strategic plan. Coming up with the answers to these questions will help you prepare for the future before a crisis emerges rather than waiting until you’re in the thick of things. It enables businesses to swim upstream at a time when the economic currents are sweeping others away.